5 essential steps to integrated reporting readiness

The global move towards integrated financial and sustainability reporting is building momentum. But what exactly is ‘integrated reporting’, and how should a company prepare for it?

The term integrated reporting has already been around for some time, often used in reference to an annual report covering both financial and sustainability information. Over the past decade, the International Integrated Reporting Council (IIRC)—now part of the IFRS—has worked to solidify integrated reporting as a more robust concept, whereby the report itself is reflective of real integration within the business.

As our understanding of sustainability has matured, this idea has become both a goal and a regulatory imperative. This is now being illustrated more clearly than ever with the CSRD, which is requiring companies in scope to adopt integration as they prepare to meet new guidelines.

For these organisations, the clock is now ticking to bring financial and sustainability reporting onto an equal footing. Those not in scope, meanwhile, have the opportunity to learn from this implementation phase among their peers and bolster their own reporting. With this in mind, let’s take a look at five key steps to integrated reporting readiness.

Step 1: Set and define your goals

First, you need to understand exactly what your organisation is aiming towards. Whether you are preparing to align with mandated or voluntary requirements, ensure you know precisely what you need to be reporting on, how you should be reporting on it and by when. If you’re working towards mandate reporting then are you clear about how much of your organisation is in scope, which entities will be required to report and how many will need to contribute data?

Alongside this, also think about your strategic goals surrounding not just your reporting, but your sustainability practices as a whole. How are you planning to go beyond compliance and drive value for your organisation, and how do these aims align with your existing business model?

Step 2: Apply the principles of double materiality

Double materiality—the consideration of both one’s own internal interests alongside external impacts—is one of the core concepts of the European Sustainability Reporting Standards (ESRS), which provide detailed instructions on how to report on sustainability issues in this manner.

As you dive into your reporting strategy, apply these same principles to examine your processes, aims and objectives. Start with your company’s existing materiality assessment and expand this to include all the internal and external stakeholders throughout the life cycle of an integrated report, identifying key areas of risk, opportunity and potential positive and negative impact.

Step 3: Assess your current state

Next, you’ll need to assess what needs changing in order to meet your aims. The amount of time you’ll need to get up and running with a more integrated reporting process will depend on your company’s size and ESG maturity level. However, you may well need to re-evaluate your people, processes and technology to meet the raised bar set by the standards, audit requirements and long-term aims of integrated reporting.

Starting from your goal date, work your way back, taking into account everything that will need to be done, from the assessment and restructuring of processes, to the time your team members will need to adapt to new technology and processes, to report creation and tagging requirements.

This assessment should be a dynamic and regular process, segueing directly into readiness actions while being continually revised to keep your processes in line with your aims and the current state of reporting.

Step 4: Ensure your data is audit-ready

Having regular access to reliable, accurate and up-to-date information across the board is essential for successful reporting and operation. How quickly can you access your data when needed, and how confident are you in it? Outline the journey your data goes on, flagging areas where risk, speed or accuracy may be an issue. This data informs your goals, helps measure your progress and forms a key part of your sustainability communication and report. Your ESG data needs to stand up to the highest level of scrutiny, so addressing any inefficiencies at this stage is crucial.

Step 5: Integrate your reporting practices

As mentioned, an integrated report needs to reflect a fully integrated, cohesive and consistent way of working.

For many, achieving this will require a reconsideration of team structures and collaboration methods. A cross-functional response—including finance, sustainability, risk, communication, HR and procurement teams—is needed, but how this looks is likely to look very different depending on the size and individual needs of your company. Frequently considered options include adopting the ‘centre of excellence’ model: a small cross-functional team who can advise, champion the needs of integrated reporting, and help drive integration throughout the entire company as well as bringing a core of sustainability reporting responsibilities more directly under the CFO.

How long should this take?

The time it takes to integrate reporting practices in preparation for a particular standard or framework will vary considerably depending on the size of the organisation, its level of maturity in ESG reporting and its existing processes surrounding non-financial data.

While there is no ‘one-size-fits-all’ approach, our general recommendation would be to test your reporting processes at least one year ahead of any mandatory third-party assurance.

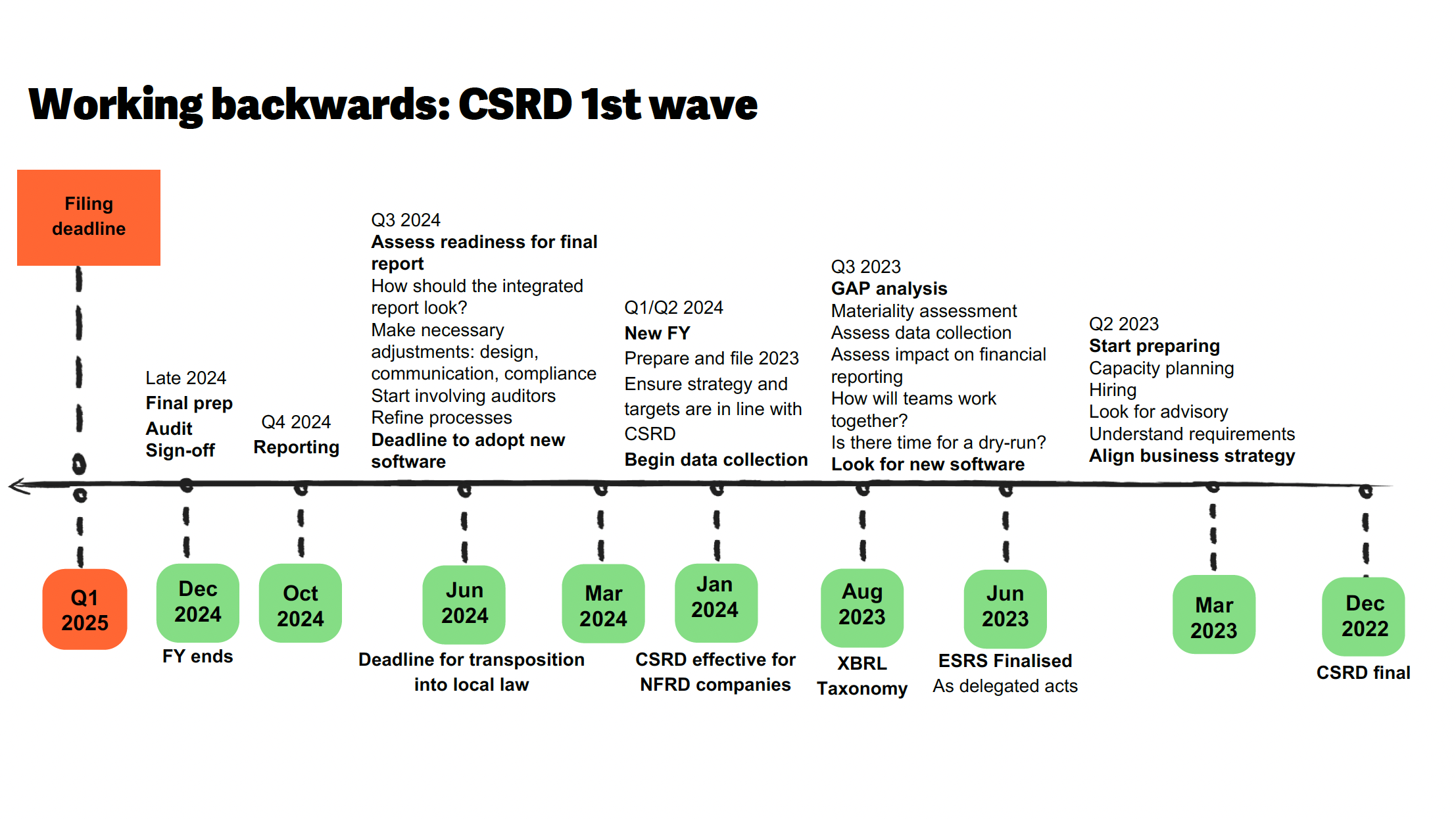

With the CSRD reporting deadlines in mind, here is our estimated guide for implementation timelines:

Companies that have identified substantial data gaps, as well as those with numerous entities, should allow for additional time to establish new processes and gather the data they need. However, it’s also important not to let perfect get in the way of progress. For many companies, it may well be necessary to continue strengthening their data, processes and audit preparedness in a continuous and iterative manner alongside the reporting itself.

Our advice: readiness is not a one-time fix

While preparation for a specific regulation such as CSRD may initially be evaluated as a one-off process, it is worth remembering that sustainability is still evolving, and ongoing adjustments and changes will be needed. Rather than viewing readiness as an entirely separate phase, all of these steps should be regularly revisited as you build value for your organisation by continuously assessing, strengthening and further integrating your sustainability and reporting practices.