Continuous Improvement in the Financial Close Process

More accounting and finance teams are being asked—and expected—to be strategic partners to their organisations. Yet, they cannot always find the time to analyse results and contribute forward-looking insights unless they can streamline the more tedious parts of the financial close process.

In this blog post, the last in a five-part series on steps for simplifying the financial close, I will discuss bringing continuous improvement to the month-end or year-end reporting process.

To recap, here are the five steps:

- Step 1: Create a process flowchart

- Step 2: Identify risks and opportunities

- Step 3: Find systems and tools for improvement

- Step 4: Implement process change

- Step 5: Continuously improve

Let's explore the last step in more detail.

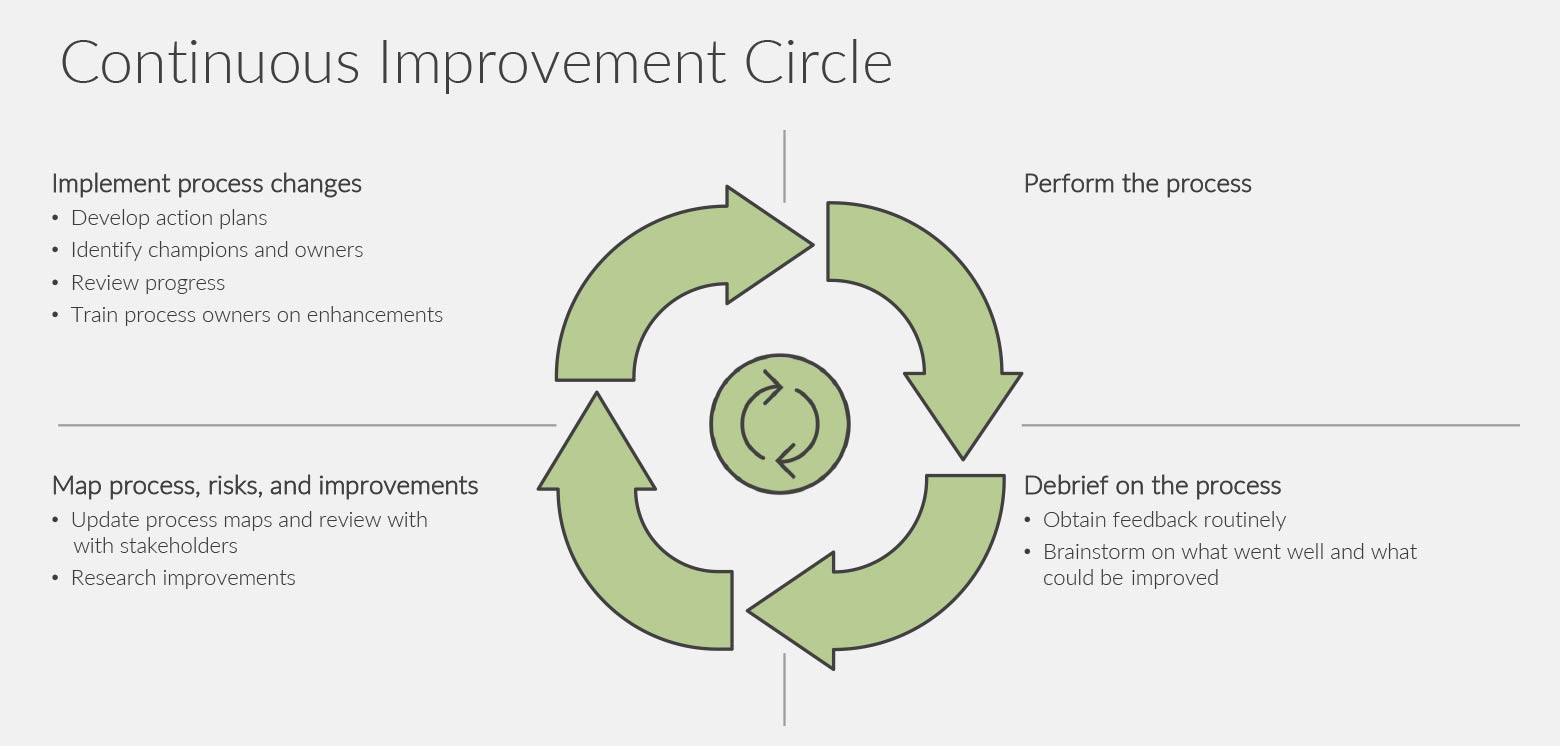

The continuous improvement circle

Today’s most successful businesses thrive by maintaining a culture of innovation. You can bring the same philosophy to your accounting and finance work by making a commitment to continuous improvement within the close process.

Perform the new process

After implementing a change, let team members know you value their feedback on what is working and what isn't as they perform the new process day to day.

Debrief on what is working and what is not

Schedule time for a post-mortem debrief with stakeholders and process owners on the changes, and set up a feedback loop, so they can share any lingering pain points as well as ideas for how to relieve them.

Map and identify the remaining risks and new opportunities to improve

If you have created a financial close process flowchart, you can update it with the feedback you have gathered, identify new risks, and identify new opportunities for improvement. (If you are a Workiva customer and have created your process flowchart in Wdesk, you can easily update it while retaining a record of old versions.)

- Have new tools emerged that would help your team with financial close process improvement?

- Does your existing software or technology solution have features you have not used yet?

- Can other teams within your organisation also use the technology you have adopted, so you can make the most of your investment?

- Are APIs available to connect more of your technology solutions to each other?

- Have you talked with your counterparts internally or externally to see what they would recommend?

Communicate early and often on the changes ahead

Make team members aware of the improvements you would like to make. Train process owners on the changes, and implement them. Identify a senior leader to advocate for simplification, and include her as you update your team and organisation on your road to continuous improvement.

Then repeat the process.