The Controller Checklist: 6 Questions for Trusted Reporting

The past few years have probably provided plenty of moments of near-paralyzing anxiety for those in accounting.

Maybe you can relate. Just about all CFOs in a survey by FSN and Workiva said the financial reporting process keeps them up at night, and that was before our world was turned upside down.

Fallout from geopolitical turmoil, new regulations, natural disasters, and economic turbulence can force teams to revisit financial forecasts and quickly pull data to answer questions from executives and the board about the balance sheet, cash flow, and financial health of your organization.

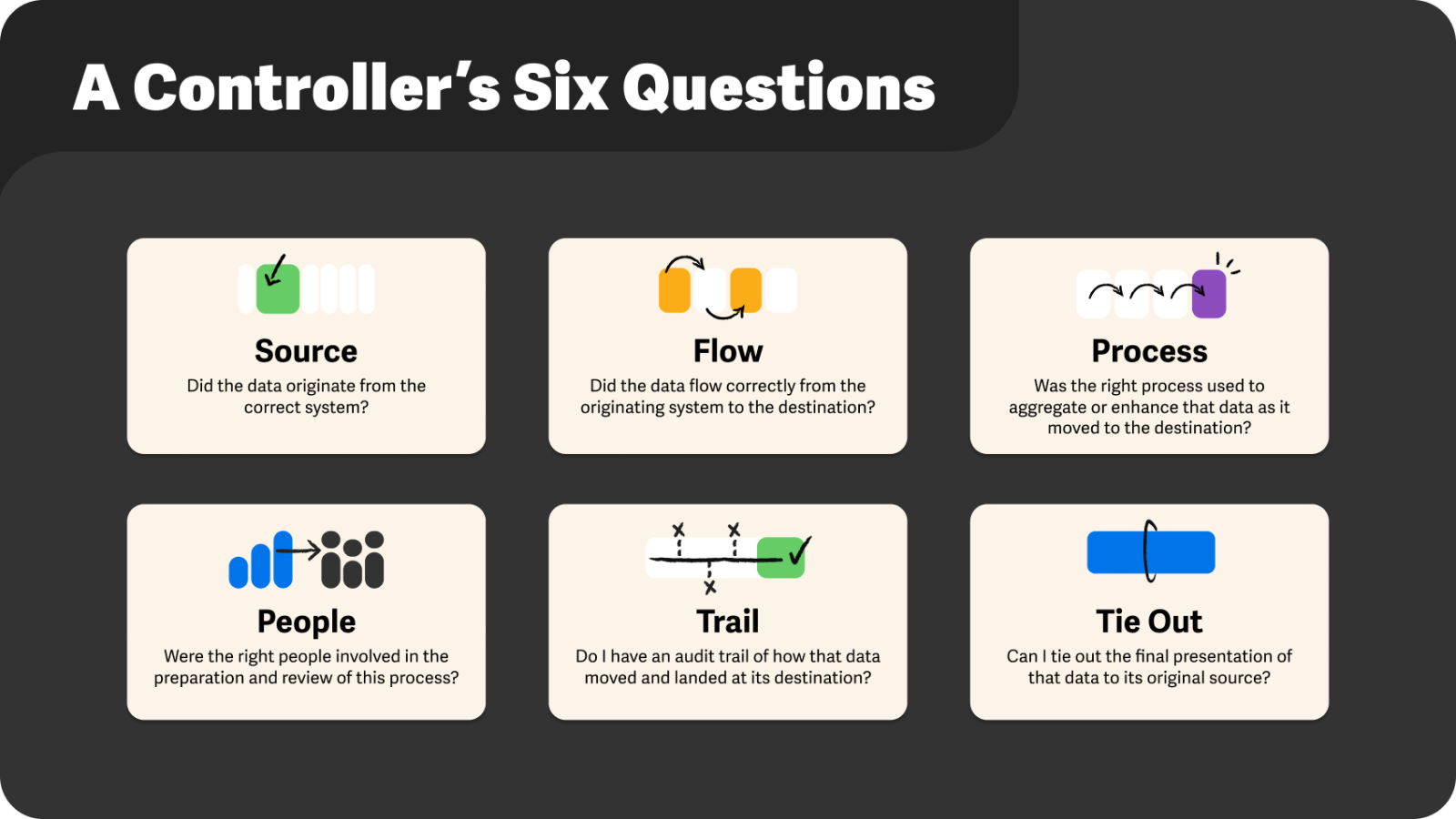

The six questions to consider: the checklist

During my time leading global accounting teams, I quickly realized that there was no way I could re-perform all of my teams' work to ensure it was correct. Over the years, I learned to reduce the risk of errors through a properly designed and consistently followed process, relying on these six questions as guideposts.

If I could answer these six questions satisfactorily, I had a high level of confidence in what I was asked to review and certify, and I was comfortable with the risk of error.

The need for a connected system of work

Without a way to automatically connect data directly from the general ledger, ERP, or other source to your reports, or a scalable and controlled manual data collection process, it can be challenging to answer "yes" to all six questions. And this process only gets more challenging when you add non-financial data to the mix.

While organizations have invested billions of dollars in financial transformation efforts in recent years to make sure transactions are accurately recorded, closed, and consolidated, the steps involved in financial reporting after consolidation haven't always kept up.

Too often, teams must manually export or copy data from source systems, manually assemble the data, and format the data themselves for reporting purposes. Often, the real risk of errors that can lead to a material weakness and restatement lies in error-prone manual financial reporting processes, rather than in upstream systems like ERPs or data warehouses.

This could be an opportunity to take the leap and adopt a connected system of work to automate the most manual, error-prone steps in assembling financial reporting outputs.

How Workiva can help

By using a connected reporting platform, teams can automatically connect data directly from source systems to a centralized reporting environment, where they can link numbers and narrative from a single source of truth to multiple reports. Even when the data live outside of source systems, the Workiva platform facilitates scalable and auditable data collection.

Thousands of organizations use the Workiva platform to help them answer the six questions above with confidence:

- Pre-built connectors allow teams to automatically connect data from source systems (like ERPs, BlackLine, and many, many others) to reports

- Teams can link data from a single source of truth across multiple instances

- Workiva users can trace data lineage all the way back to the source

- They can customize and automate steps in the process to make sure the right people prepare and review the final product

- An automatic audit trail captures a history of revisions, including who made changes and when

- You can also build data validation rules to ensure data accuracy

Technology alone may not prevent finance leaders' every nightmare. However, automating tedious parts of the financial reporting process can free your staff to do more important work than copying and pasting data, chasing rounders, or updating numbers by hand. Then they can focus on using their expertise as intended.

Learn how top teams are automating financial statements, board presentations, and financial reporting with Workiva.

The Controller’s Guide to Finance Automation

Discover how to identify key areas of weakness throughout your financial reporting processes, and how and when these can be addressed using automation in accounting and finance to help your organization.