How Does Your Legal Entity Reporting Process Compare to Your Peers?

When your legal entity reporting process is advanced and your people, processes, data and technology are connected, you can spend more time on statutory compliance and reporting. But, how well do you think these parts work together at your company? And, what about your peers?

To learn more about the challenges facing multinationals, we quizzed over 100 companies to gain insight into what really goes on behind the scenes of their reporting processes.

The answers are fascinating—they highlight several common challenges, and show where improvements can be made to add efficiency, consistency and transparency to the legal entity reporting process.

Collaborating effectively is a challenge

It is not only important for companies to have the right people in place, but an advanced global statutory reporting process also has excellent communication between these different stakeholders.

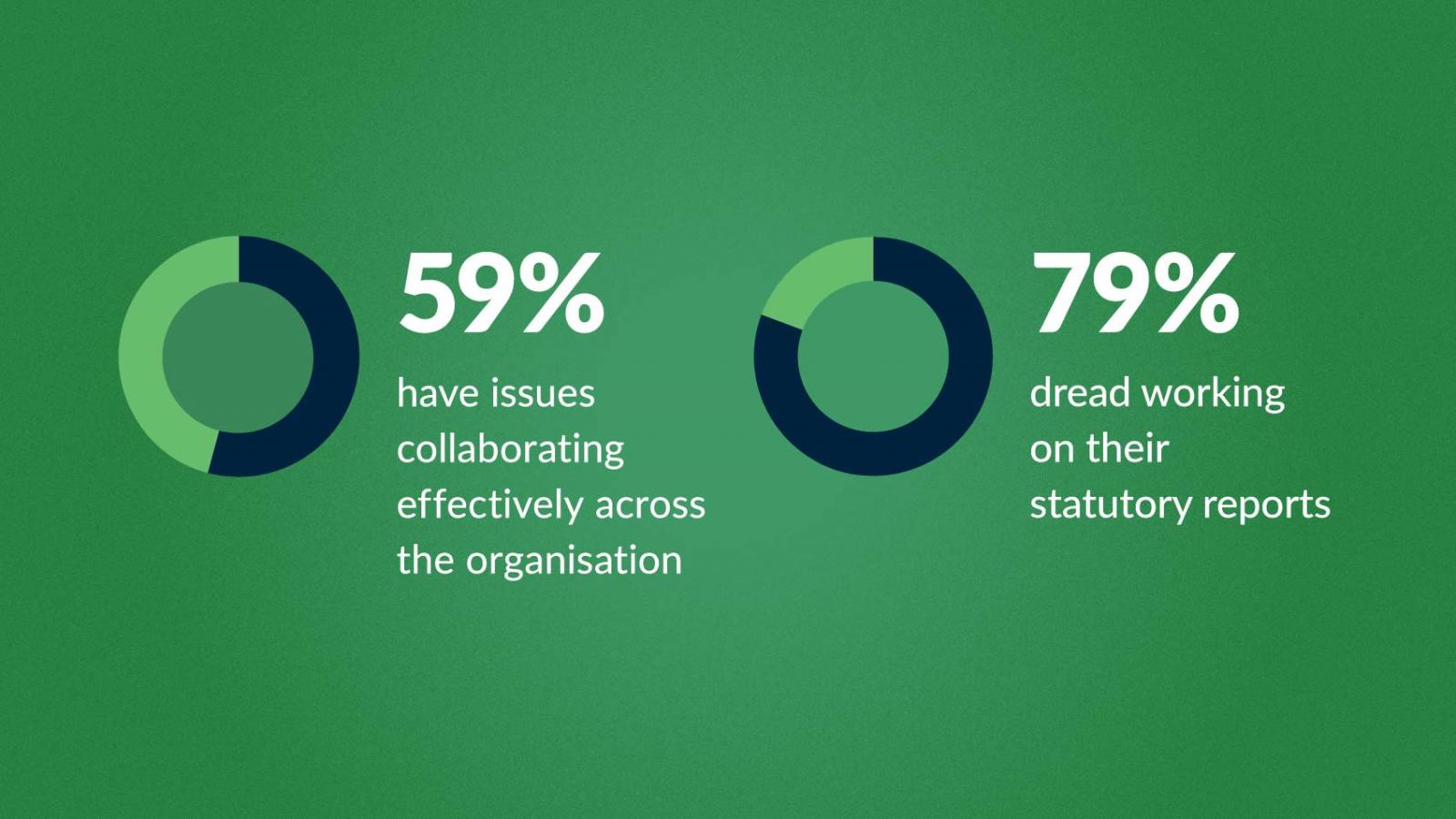

With the amount of data, number of collaborators and the different languages in many global statutory reporting processes, working in silos simply will not cut it. And, it is clear this is a challenge. Nearly 60% of respondents said they have issues collaborating effectively across the organisation.

When the global statutory reporting process lacks communication and transparency, a company may be limiting the impact and engagement of highly skilled employees. This is certainly evident in our results as 79% said they dread working on their statutory reports. Ouch!

With such importance placed on maintaining talent, this is a big issue that needs to be addressed.

How to address this challenge:

A proven way our customers have improved communication, transparency and collaboration across stakeholder groups—for example, with the tax and audit teams—is the capability to comment and review within the Workiva platform.

With everyone working together in real time in one cloud platform, bottlenecks and inefficiencies are removed. This enables employees to use the full scope of their expertise to increase their impact across their teams and can lead to higher morale, lower turnover and more opportunities for career progression.

Disconnected processes

As a result of the COVID-19 pandemic, companies around the world were forced to work remotely, seemingly overnight. This rapid transition exposed gaps in the disconnected, desktop processes common in global statutory reporting.

Over 50% of our respondents said they do not have a well-documented and measurable statutory reporting process, and they don't monitor their progress each cycle. Without this documentation, the knowledge of how the process actually works tends to lie with just a few individuals. Now, imagine what happens when everything is turned upside down and the teams can’t access that offline file or one of the key members of the team isn’t available. The whole process can collapse in an instant.

How to address this challenge:

This shows a clear opportunity for these companies to define, document and streamline processes across the enterprise, so employees can focus on delivering strategic regulatory compliance—not just execution.

To address the gaps in the legal entity reporting processes exposed during the COVID-19 pandemic, the trend has been to accelerate the centralisation of reporting processes around cloud-enabled platforms. This provides companies with the ability to control, trace, collaborate, trust and reduce risk when assembling their statutory financial reports.

Need a push to break from the status quo

The global statutory reporting process for many companies involves manual desktop processes that they are trying to fit into a digital world. These desktop processes are seldom automated end to end, and they require multiple manual iterations and interventions to manage the process in full. In fact, when you sit down and audit them in full, quite often, they're found to be broken.

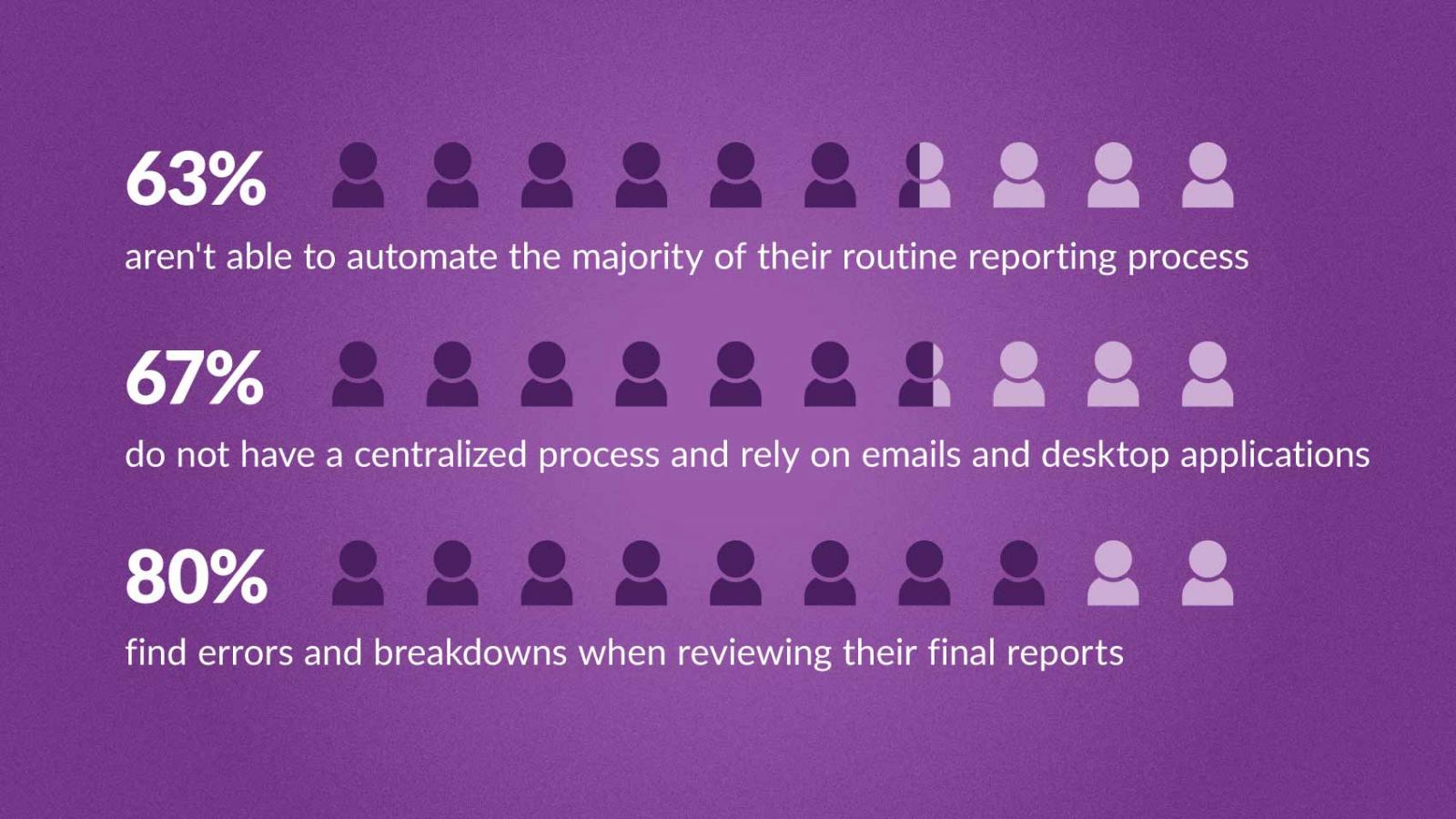

This is a challenge for our respondents, as 63% are unable to automate the majority of their routine reporting process, and 67% rely on emails and desktop applications. It’s no wonder that 80% of our respondents said that they find errors and breakdowns when reviewing their final reports.

How to address this challenge:

Finance teams are starting to break away from the status quo and are moving to a platform-based process where the record, aggregation, assembly, review and reporting can all be done inside a platform which reconciles and integrates the system of record with the system of work.

By bringing together all stakeholders in one platform and creating a single source of data, companies are provided with a level of control, traceability and collaboration that delivers long-term sustainable reporting benefits.

How do you compare?

Curious to see how your statutory reporting process stacks up against your peers? Check out this infographic to see all the results.

And, you can take our quiz to see where you are today and what steps you can take to bring your statutory reporting to the next level.