The Ultimate IPO Guide for Private Companies

For many companies, an initial public offering (IPO) is a significant achievement that symbolizes value for founders, employees, and customers—but risk and challenges can arise if you are unprepared. In this ultimate IPO guide, you will find the importance of IPO readiness ahead of ringing that bell.

What is an IPO and how does it work?

An IPO is the process of a private company offering stock to the public to raise capital for the first time. But as a public company, you will be subjugated to an array of rules, regulations, and standards that you weren’t held to as a private company.

The IPO Timeline & Considerations

What is the typical IPO timeline?

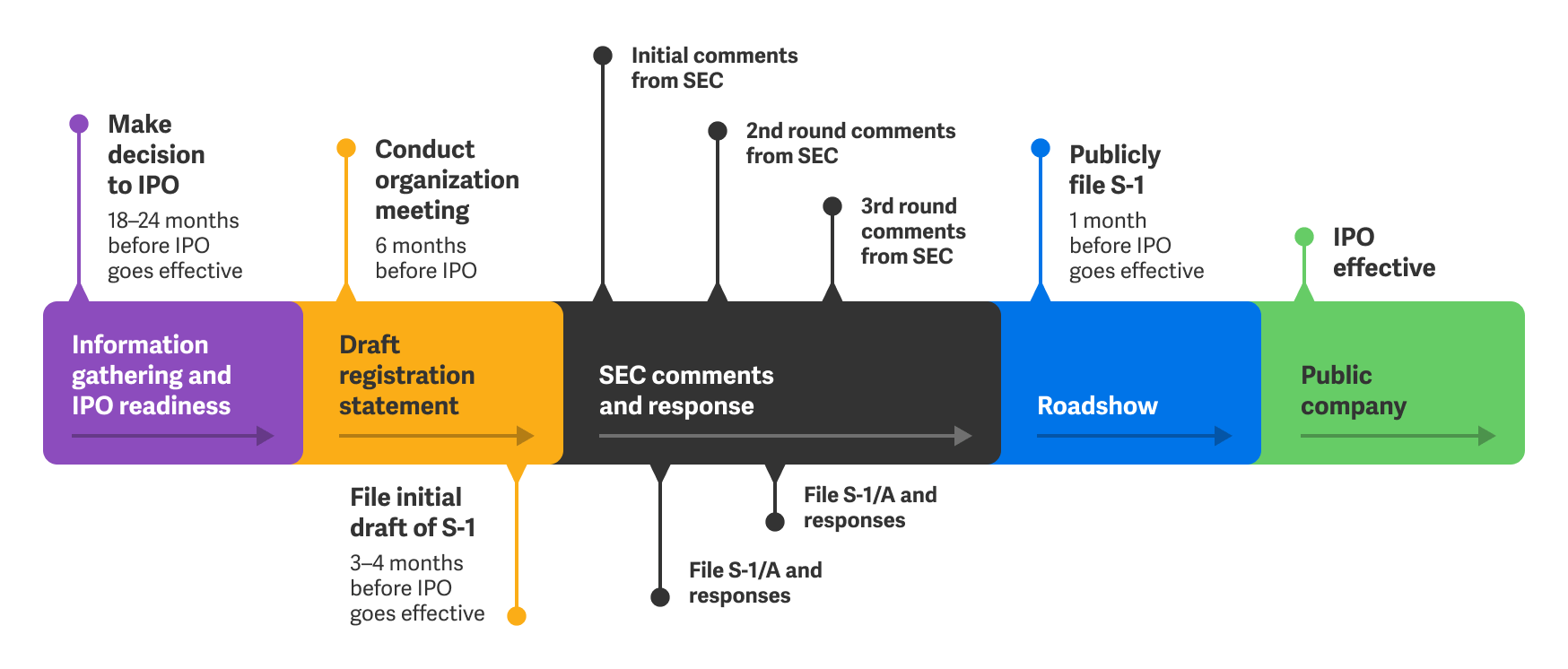

While an IPO timeline can stretch across years, many professionals recommend you operate as a public company for one to two years before actually going public. There are about six key months during the IPO process.

Who is involved in an IPO?

Many stakeholders are involved in the IPO process, so it’s critical that the right team is in place for a smooth process. What are they responsible for?

- CFO: Ensures the financial statements are accurate and accessible. They are also the public face of the transaction.

- Legal counsel: Reviews securities laws and guides the organization throughout the IPO process. They oversee the preparation of the registration statement and also consult the company during key filings with the SEC.

- Underwriter: Responsible for comparing past records and performance, preparing documents, filing statements, and managing issuance during the IPO process.

- Filing vendors: Responsible for making sure the registration statement is accurate and filed correctly.

While these stakeholders are the most involved, nearly every role at a company plays a part throughout the steps in an IPO process.

What are the IPO considerations?

Are you considering the possibility of an IPO? Ask yourself these questions to gauge your IPO readiness:

- Is the market timing right?

- Do I have the right team to coordinate an IPO?

- Can we afford to go through the IPO process?

- Are we able to predict future financials?

- Can we navigate public shareholders and SEC regulations?

Your Own IPO Checklist

As the CFO, you’ll be responsible for aligning company financial information, future vision, and also be the public face of the deal. There will be a lot of moving parts in your role so be sure you understand all your responsibilities:

- Review all accounting applicable standards and policies to verify the positions are properly documented and will withstand any questions or scrutiny from regulators

- Draft and prepare financial statements (for 2-3 previous years) in accordance with PCAOB (Public Company Accounting Oversight Board) standards

- Engage auditor to attest to PCAOB financial statements

- Assess risk and assurance with internal controls over financial reporting and determine scope under 404a or 404b, if necessary

- Select team of underwriters, legal counsel, and external auditors

- Assess accounting and finance team reporting needs and invest in transformation if necessary in order to be able to comply with new internal and external reporting requirements

- Evaluate your current accounting and data systems to ensure they are sufficiently capable to operate under public company scrutiny

- Determine you issuer type (domestic, foreign, under JOBS or ECG Act)

- Determine the IPO type structure and timeline

- Select stock exchange and reserve stock symbol (ex., NYSE, NASDAQ, Global Select Market)

- Select a financial printer and/or SEC filer

- Support and provide necessary information for the registration statement

- Prepare and present roadshow with underwriters

- Assess SOX compliance policies for post-IPO

As the general counsel, you’ll be responsible for risk management and governance matters throughout the IPO process. There will be a lot to balance in your role, so here’s a checklist of major milestones:

- Evaluate the corporate governance matters and legal structure of the entity and make necessary changes to become a public company

- Prepare or update governance policies

- Execute any necessary compensation agreement or “lock-ups”

- Select external counsel to assist with the IPO offering

- Determine type and structure of offering

- Begin the preparation of the registration statement

- Evaluate and select an underwriter

- Select a financial printer

- Select transfer agent and registrar

- Analyze transaction and assess conflicts of interest

- Conduct legal and accounting due diligence throughout the IPO process

- Review contracts, documents, and registration statement draft

- Prepare and present roadshow with underwriters

- Prepare any necessary Board resolutions

- Execute final SEC pricing and issuance filings

- Launch press release

- Support ongoing SEC reporting requirements under the ‘34 Act

As the law firm to a company preparing for an IPO, you’ll be responsible for aiding and guiding the organization throughout the IPO process. There is a lot to balance from client’s needs to SEC needs, so here’s a checklist of the major milestones:

- Organize and kickoff the working group team

- Begin the preparation of the registration statement

- Incorporate financial statements and corporate governing documents into the registration statement

- Provide guidance and assemble due diligence for the offering

- Review and help negotiate underwriters agreement

- Draft, review, and help file the registration statement

- Prepare responses to SEC comment letters

- Execute price offering documents

- Finalize any underwriter and offering agreements of any other housekeeping items

- Prepare any necessary Board resolutions

- Execute final SEC pricing and issuance filings

- Launch press release

SEC Registration statement drafting, review, and filing

After you’ve evaluated your IPO readiness and who is involved, the next step is to choose how you will file your SEC registration statement. Filing for an IPO has been standardized for years as there’s traditionally been one option for your filing agent.

What is a filing agent?

Filing agents help both private companies to go public and help public companies with their ongoing SEC filings. Typically they offer a technology platform and services to help customers with drafting, managing, filing, and printing physical pages of SEC filings—including registration statements, proxy statements, financial statements, and many others.

For a long time, using a financial printer was the only option for companies going public. But our world is becoming increasingly digital and that means options for filing for an IPO have too. With the growth of technology, there are cloud platforms that now handle drafting, filing, and reviewing in one spot. The entire working team can collaborate, review, and file at their discretion versus being subject to traditional printer turnaround time.

Modern platforms can do all your drafting and collaboration—including the registration statement, any financial information, and reviewing redline changes—in one place from start to finish without waiting and relying on a traditional printer.

What’s the difference between Workiva and a financial printer?

Workiva does offer printing services, but it’s so much more than that. In the Workiva platform, you can connect your data across reports and documents automatically with syncing in the cloud and permissions down to the cell. Avoid frustrating inconsistencies, endless versions, and formatting issues and make your IPO process as seamless as it can be.

Public companies are held to tight deadlines and standards, ones you can’t risk in the name of tradition. And technology should support the transactions that will help your company grow, managing documentation for follow-on and secondary offerings.

If you’re not ready to begin drafting your registration statement just yet, you still can use the Workiva platform to prepare by implementing a regular financial reporting cadence. This is made easier with a modern platform with automation and linking built in across processes.

Ringing the bell: What’s after an IPO?

Most companies consider and plan extensively for the IPO costs during their IPO process but don’t account for the regulatory and reporting requirements as a newly public company.

The planning, preparation, and accounting and legal fees from these reports add up. As new rules and regulations are adopted, the extent and costs of your reporting requirements will increase too. Here are some things you need to consider as a public company:

Secondary and follow-on offerings

SEC reporting

SOX compliance

ESG reporting and future regulations

The SEC provided guidance in 2010 that said companies might have to disclose risks and opportunities related to climate change. In 2021, the SEC stated that it would propose amendments to enhance those disclosures.

As the SEC releases new regulations, you will have to remain agile and shift your reporting needs to meet those regulations. That’s why it’s important to choose a technology not for just one transaction, but for the entire journey of your company.