What's in a Name? A Case for the Global Legal Entity Identifier

The following article is based on a Datashare podcast recorded by the authors, available here. Datashare is a production of the Data Coalition. Our thanks to the Data Coalition for permission to share its content.

A person's name is distinct yet rarely unique. For example, your city may have a "Main Street" or a "23rd Avenue North" that distinguishes it from all other streets in your area, but there are many other instances of those names in other cities. This ambiguity creates problems for those who work with location-based data. Geospatial locations resolve this ambiguity problem by identifying locations relative to the earth. The Global Legal Entity Identifier System (GLEIS) achieves the same unique identifiers for legal entities, globally.

What is a Legal Entity Identifier (LEI)?

The Legal Entity Identifier (LEI) is a reference code global entity identification system that is used across markets and jurisdictions to uniquely identify a legally distinct entity that engages in a financial transaction. Risk managers and regulators can use the global entity identifier to identify parties to financial transactions with instant precision.

This article provides an overview of the LEI, formalized as the ISO standard 17442, with implementation managed by the Global Legal Entity Identifier Foundation (GLEIF).

The high cost of distrust

Would you buy a debt instrument where the obligated party couldn't be identified? "Of course not!" you say? That means you—and, actually, all of us—have learned something from the global financial crisis of 2008–09.

Back in 2008, when Lehman Brothers collapsed, banking supervisors around the world were asking financial institutions a very simple question: “What is your aggregate exposure to Lehman Brothers?” The answer that came back consistently across all the major financial institutions was: “We don’t know, and it will probably take weeks, if not months, to get an answer.”

The apparently simple question called for the carrying out of a complicated task that required:

- A transparent overview of the corporate structure

- The ability to uniquely and specifically identify counterparties (in order to avoid possible domino effects or circular obligations)

Back in 2008, there was no way to generate this comprehensive, real-time view of the organization’s legal structure and information about counterparties. Decision-makers were left to guess.

It was a very expensive lesson.

A simple piece of data and a sophisticated system

Many of the more than 50 major entity identifiers in use globally are simple systems. A regulator issues an ID usually with a lightweight technology infrastructure supporting its use. For those in the U.S., think of receiving your Social Security number. The downside is that critical tasks—such as automating the calculation of exposure—are complicated or impractical. What seems simple upfront can be costly downstream. Think of how the simplicity of the Social Security number system has enabled identity theft.

What the regulatory and financial service worlds recognized after the global financial crisis was the need for—and shared benefits from—a sophisticated legal entity identifier system which brings simplicity to critical tasks. Identity authentication is one such system that received well-deserved attention.

In 2011, the Group of Twenty (G20) called on the Financial Stability Board (FSB) to provide recommendations for a global Legal Entity Identifier (LEI) and a supporting governance structure. This led to the development of the Global LEI System which, through the issuance of LEIs, now provides unique identification of legal entities participating in financial transactions across the globe.

How does the Global LEI System work?

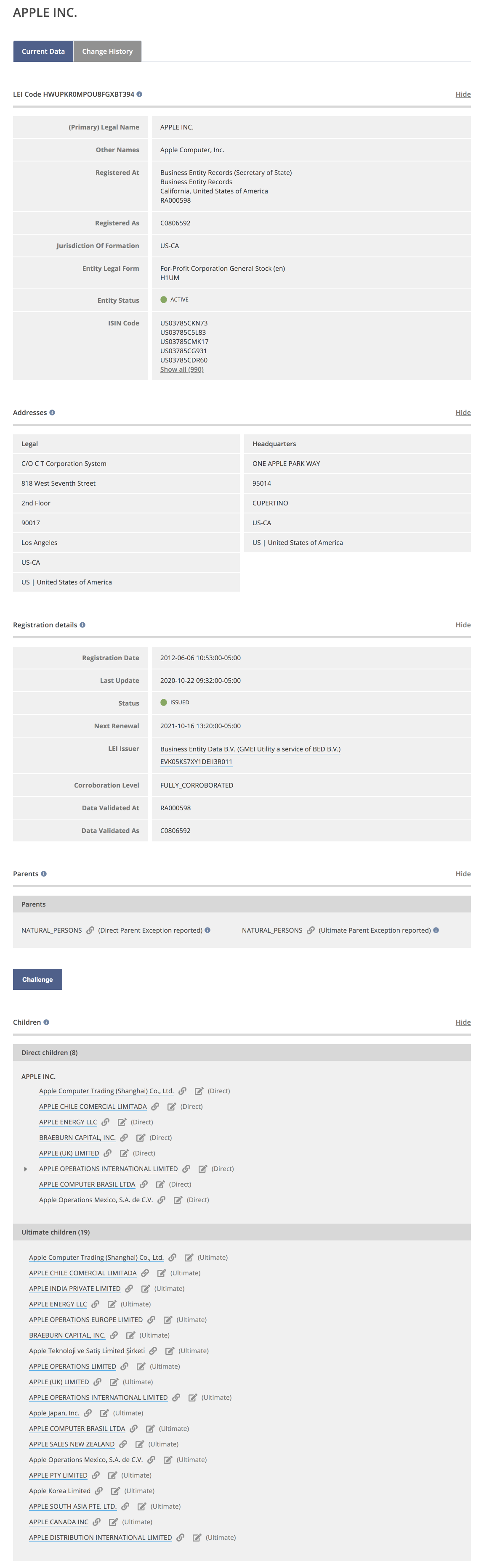

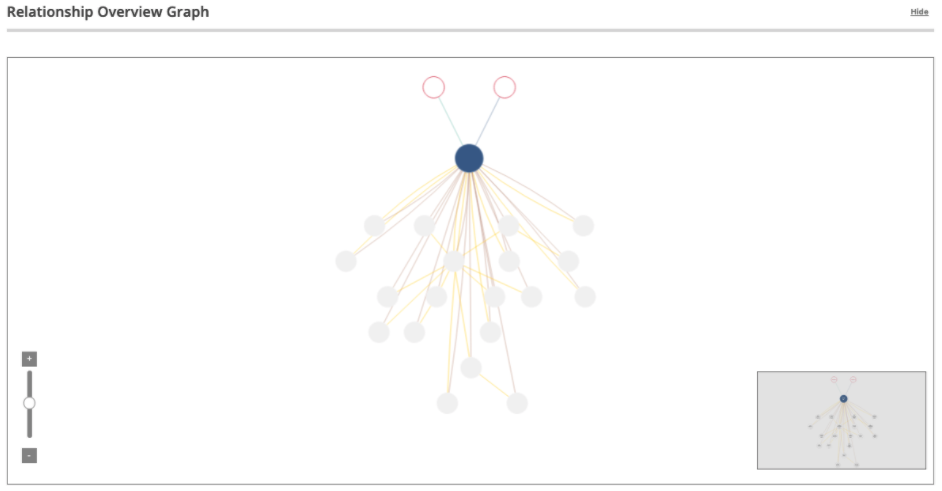

The Global LEI System (GLEIS) assigns 20-digit, alphanumeric LEIs to uniquely identify legal entities participating in transactions worldwide. Each LEI contains information about an entity’s ownership structure and thus answers the questions “who is who” and “who owns whom” among market participants.

Source: GLEIF

The details above represents a legal entity identifier example, describing a point in a network of entities which have, in this case, ownership-by and owned-by relationships between them. The knowledge behind this LEI visualization is the kind of knowledge sought by that same question from 2008: “What is your aggregate exposure to Lehman Brothers?”

Source: GLEIF

The Global LEI system is the critical component of the only open, commercially neutral, standardized, and regulatory-endorsed system capable of establishing digitized trust between all legal entities, everywhere.

The Global LEI System is set up as a federated system. The Global Legal Entity Identifier Foundation (GLEIF) is a non-profit Swiss foundation, managing a network of partners—known as the LEI issuing organizations—and ensures the operational integrity of the Global LEI System. Meanwhile, there are 39 accredited LEI issuing organizations. The Regulatory Oversight Committee (ROC) ensures rule compliance by all participants of the system.

Why do we need a Global LEI System?

The issue of trust is central to all of this and can be a real sticking point that hinders development. GLEIF’s vision is to enable people and businesses worldwide to make smarter, less costly, and more reliable decisions about whom to do business with. But how can an organization trust that a supplier located a significant distance away is who they say they are? Or, as a person, how can I verify that the organization receiving personal data is who I believe them to be? That is the problem global legal entity identifiers and LEI lookup systems are trying to solve.

The challenge is increasing. As more processes and interactions become digital, stakeholders must work harder than ever to legitimize trust.

This puts the field of identity management via legal entity identifiers at the heart of digital transformation. One focus area is promoting the LEI to enhance digital certificates and signing in financial reporting. For example, in order to ensure the integrity of their annual report, organizations can now embed the LEI in the XBRL® format and in the digital certificates used by the executives for signing of the reports.

Another effort leverages the use of the LEI in Verifiable Credentials to create verifiable LEIs (vLEIs). Verifiable Credentials are defined as the format for interoperable, cryptographically-verifiable digital credentials being defined by the W3C standards organization (i.e., Verifiable Claims Working Group).

The Global LEI System can benefit the industry

According to Financialresearch.gov, “As the global LEI becomes more widely used, it should cut costs and improve risk management for individual firms and across the financial system. These savings will come from reducing transaction failures, lowering data reconciliation, cleaning, and aggregation costs; and trimming regulatory reporting costs.” In other words, the Global LEI System makes internal risk management easier by clearly defining their counterparties and the customers they serve.

If you are responsible for the digital transformation of your organization, especially regarding regulatory reporting, consider registering for an legal entity identifier (LEI) and beginning to learn how to leverage the LEI system to foster trust in your electronic records and in your financial and regulatory reporting. In fact, see how your legal entity reporting process compares to your peers. The shared benefits grow as more organizations adopt the Global LEI system. This is one standard where compliance is inexpensive, easy to adopt and maintain, and ever-growing in value.

Ready to learn more about how Workiva can work for you? Request a demo with a representative today.

XBRL® is a trademark of XBRL International, Inc. All rights reserved. The XBRL® standards are open and freely licensed by way of the XBRL International License Agreement.