6 Tips to Improve Your Financial Reporting Process

Producing financial reports to keep internal leaders and external stakeholders informed is becoming more complex each year.

As companies aggregate more and more data from multiple departments and systems, financial reporting teams face a higher volume of data reconciliations, spreadsheet searches, report consolidation, error correction, reviews, approvals, and more. Not to mention the headaches and lost hours due to manual tasks throughout the process, involving multiple people—from potential copy-and-paste miscues to updating different spreadsheets to managing reviews and comments from multiple PDFs.

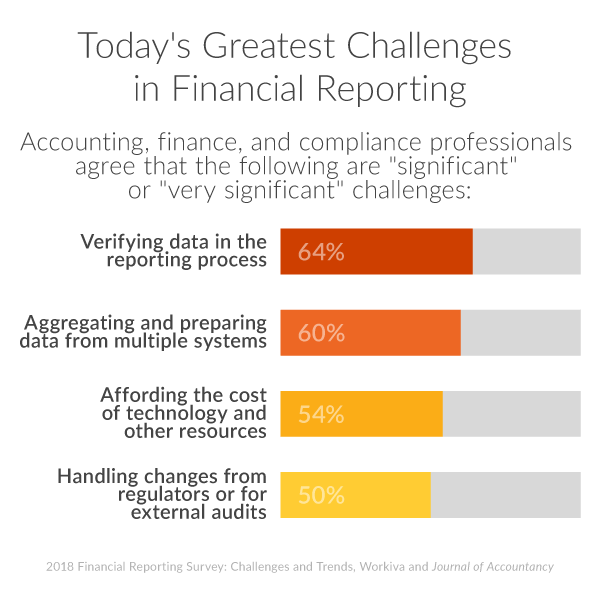

Each year, the list of key challenges confronting financial reporting teams evolves:

A key driver of the complexity is the expansion of company operating structures. In an EY survey of 500 large companies, fully half said they have more than 10 business units. Meanwhile, more than 60 percent of them have created new legal entities or entered new jurisdictions during the last three years. As a result, three-quarters of the companies use more than five financial reporting systems, and more than 66 percent file more financial reports now than three years ago.

That complexity is bound to create data governance and data transfer issues if manual processes are still the primary way to drive the information pipeline from entities and subsidiaries back to the parent company.

Fortify your processes in six steps

In my white paper Financial and Management Reporting Process Improvement, I explored how companies can stabilize their financial reporting processes against these challenges. Huge possibilities abound when companies connect financial and nonfinancial data as well as narrative content across a single cloud platform to produce financial and statutory reports.

However, investing in technology and enterprise connectivity is not the first and only approach. No matter how experienced a team is, consider returning to some fundamental principles for improving the financial reporting process.

Evaluate how well your company and your team are performing with these six steps that should be part of any well-designed financial reporting structure.

1. Collect and normalize your data

- Create flexible templates that enable contributors to submit structured and unstructured data in a consistent fashion

- Leverage a consistent collection process to normalize your data, so you do not have to worry about reformatting

2. Organize your information

- Build and define datasets that can be managed through tagging, filters, and other metadata controls

- Develop report guidelines, templates, or standard formats that can be applied across your organization

- Use permissions to limit who can view and edit specific documents, pages, or spreadsheet cells to help preserve data integrity

3. Work from a single source of data

- Store every data element in one place

- Establish links between source data and all related destinations, so that when a figure changes, that change can propagate through all the destinations

- Make sure everyone pulls data from the source repository to eliminate errors and inconsistencies

4. Collaborate across the organization

- Create a shared yet secure financial reporting environment where users can work concurrently, not one at a time

- Eliminate wasted time by avoiding processes that involve checkout systems, shared drives, and other workflow bottlenecks

- Clear up version control questions with a single live document with an audit trail into changes, rather than resaving and renaming files

5. Review, approve, and sign off on the same document

- Create an environment in which far-flung authors, editors, reviewers, and auditors can work together on that document rather than in isolation

- Set expectations for everyone to leave feedback within the document, rather than in emails or offline, so everyone can track the group's questions, responses, and resolutions

6. House final reports in a single location

- Give everyone on the financial reporting team one place where source information resides

- Simplify the process of searching for the most recent data to flow into narrative reports, dashboards, workbooks, and presentations

- Make rolling forward easy by using a report from the previous period as your start for the current one

Move beyond traditional processes

Two-thirds of CFOs and senior finance executives say too many of their resources are tied up in outdated systems and traditional ways of working, according to a report by FSN and Workiva.

Evaluate how these six tips for improving the financial reporting process measure against what you do today. By applying these best practices, you might find underlying weaknesses in workflow and identify clear opportunities for improvement. Fortunately, most of the common areas that still frustrate financial reporting teams—lack of control over data management, stifled collaboration—can easily be addressed with the right technology.

Don’t wait! Register for a free Amplify account and stream select sessions until Oct. 31, 2023. Explore how financial reporting, ESG, and GRC intersect.

Financial Reporting Process Improvement

Learn the common financial reporting challenges and methods for change.