Finance Transformation Versus Stagnation: Survey Reveals Impact of Innovation in Finance Function

The results from the latest FSN global survey on the finance function are in, and the big takeaway comes down to this: innovate or stagnate.

The survey of 1,037 international senior finance professionals from the FSN Modern Finance Forum on LinkedIn gathered critical insight on how finance executives from around the world view the potential for financial transformation and the perils of ignoring it.

It is clear that the days of finance teams being chained to traditional spreadsheets, struggling with legacy systems and working in silos that stifle collaboration are waning. 67% of survey respondents acknowledged that too many people and resources are tied up in outdated systems and processes.

They agreed that while transitioning from legacy systems and standard procedures is not always comfortable, it is critical for improving processes and reducing risk. Early adopters of technology—like cloud computing and collaborative platforms—are working smarter, riving higher levels of performance and moving beyond finance functions to help lead enterprisewide innovation, the survey results suggest.

Here are some key findings from the FSN survey about financial transformation, including where it should begin, its benefits, and the risks of stagnation.

Innovation starts with finance

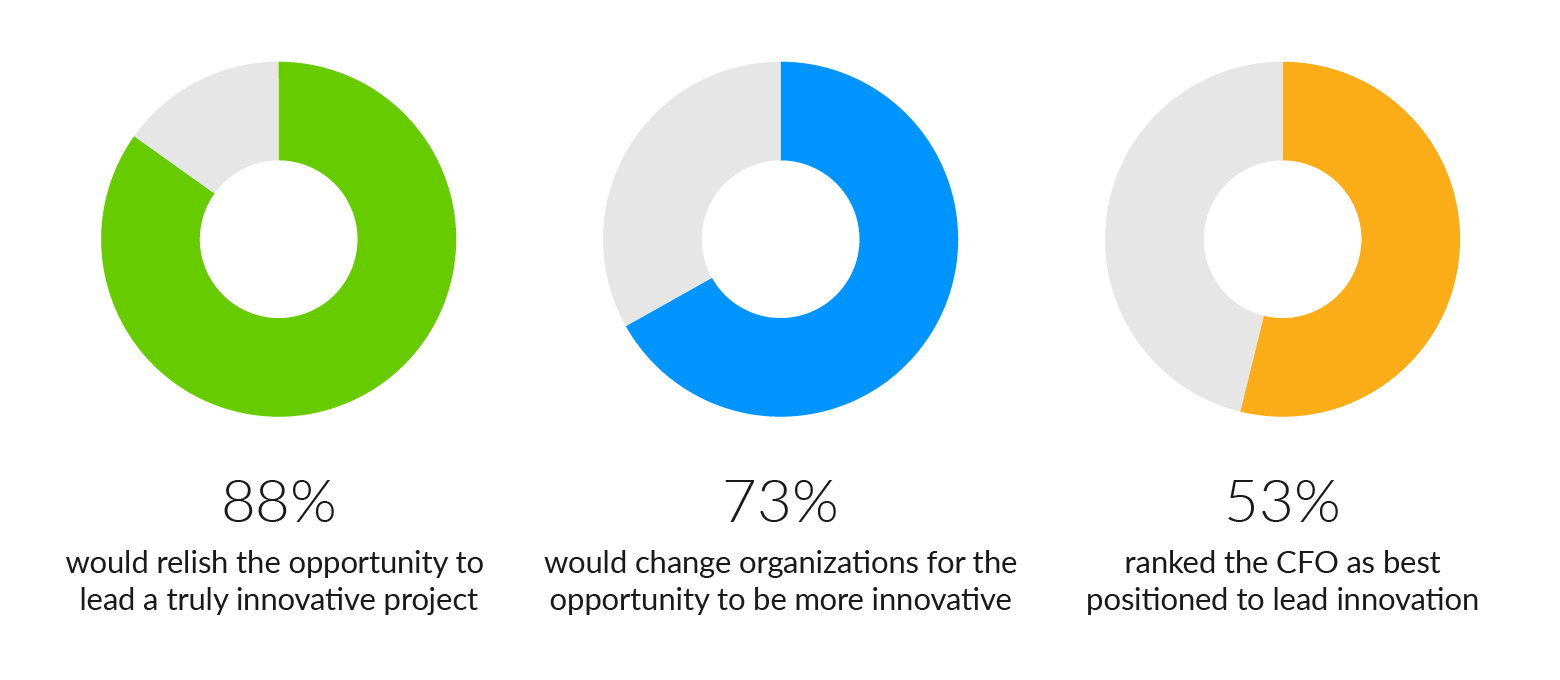

Because finance sits at the confluence of all business functions and owns the data that drives business decisions, finance executives are uniquely situated to lead enterprisewide innovation.

Survey respondents agree that finance needs to lead the way on innovation for the business. According to respondents, 85% of CFOs and senior finance executives think innovation is a "must” to drive better business insights. And when financial leaders step out from behind the finance desk and help lead enterprisewide transformation, the results are dynamic.

Top 3 benefits of financial innovation

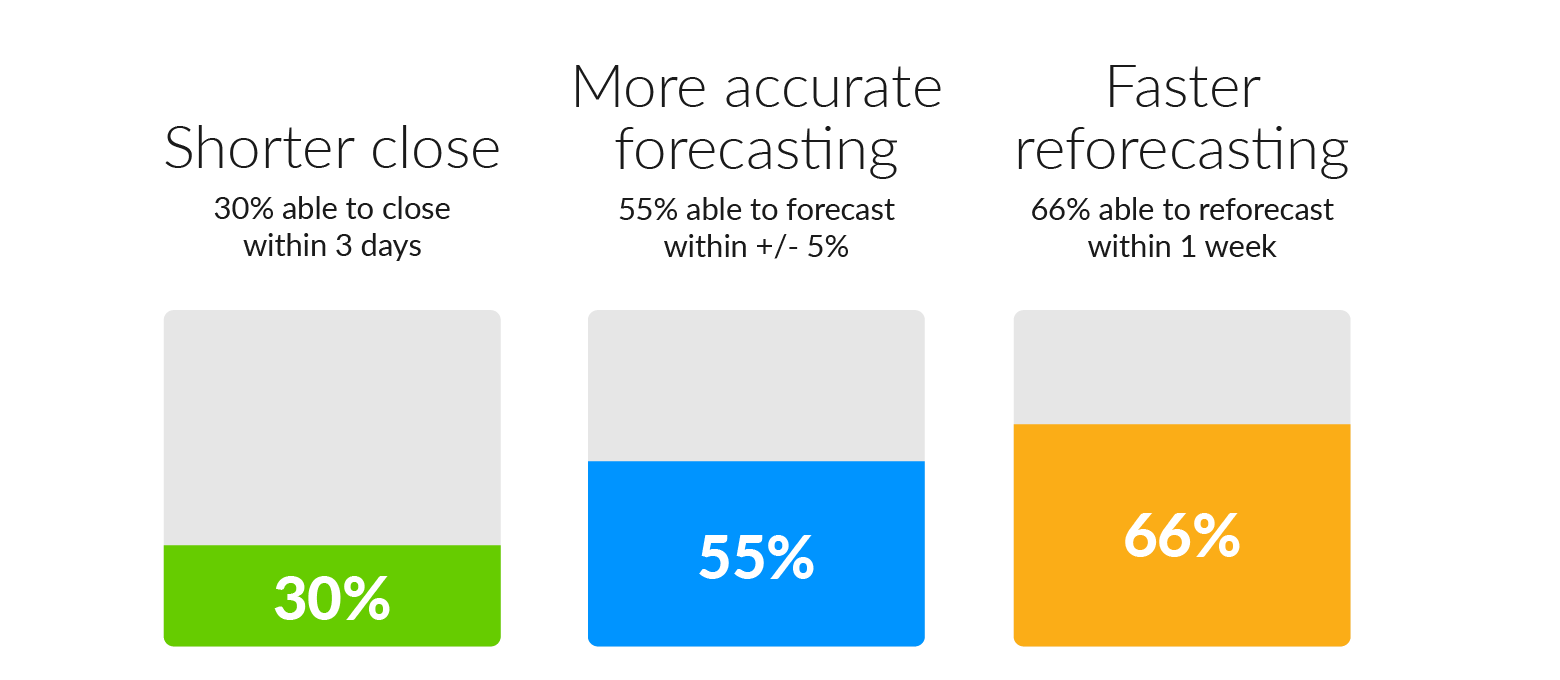

When finance drives innovation, the company benefits from better data and greater insight to inform decision-making in the C-suite. With the right tools and people, innovative teams achieve a faster financial close, create more accurate forecasts and are more agile when called upon to reforecast.

1. Shorter financial close

The faster you close the books, the sooner you will have insight to drive key business decisions. The survey shows that true innovators achieve a faster financial close: 30% of innovators close their books within 3 days versus 17% of those from companies not committed to innovation.

2. More accurate forecasting

Leaders need an accurate financial view of what is ahead to plan accordingly, and that starts with finance. The survey shows that innovators consistently produce better numbers for decision-making. Of true innovators, 55% could forecast revenue to within 5%. Only 31% of those in the “uncommitted to innovation” category could achieve that level of accuracy.

3. Faster reforecasting

Change is a constant. The ability to stay flexible and reforecast quickly helps a company stay on target in a turbulent business climate. The survey shows that 66% of true innovators were able to reforecast within one week, compared to 57% of those companies that do not devote time and resources to financial transformation.

A snapshot of financial transformation

With a market capitalisation of $3 billion, the U.S.-based health care real estate investment trust National Health Investors has 14 employees. As the company grows, the five-person accounting team and its director of financial reporting need accounting solutions that can scale.

That is why NHI has used Workiva solutions for years. The platform can handle large datasets while maintaining a robust audit trail to streamline reporting and save the team time—and headaches.

NHI's team has gained valuable time to conduct extra analysis. "We already have so much of our data in Wdesk and so many documents that we're driving with Wdesk data. It's easy to make the case that we don't need anything else," the director of financial reporting said.

Embracing the future of accounting and finance

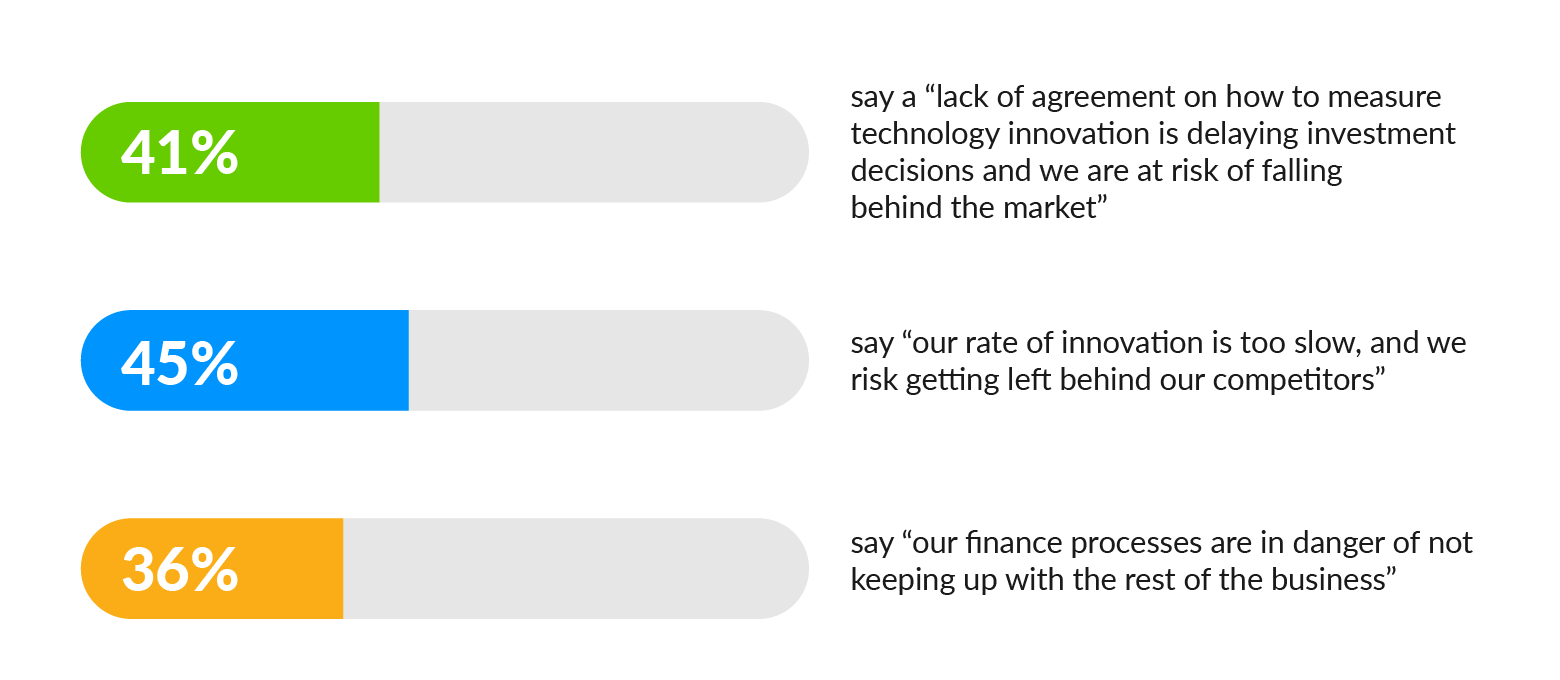

Risk is inherent in innovation. But survey respondents agree that failing to innovate poses an even greater risk. Legacy systems and traditional ways of working can slow down decision cycles by producing outdated data, reducing transparency, stifling collaboration, and consuming exorbitant amounts of time and resources. In the bigger picture, survey respondents say stagnation causes companies to lose the competitive edge and delay investment decisions that could propel the company forward.

That’s just the start

The benefits of financial innovation are clear. Unfortunately, so are the perils of stagnation. Thinking of transforming your company’s financial reporting process? Curious about approaches other companies take to innovation? Wondering how financial innovation looks around the world?

Download the full Innovation in the Finance Function Global Survey 2018 for valuable insight on financial transformation, plus more case studies, a global view on financial innovation, and more.