A Model for Advancing Financial Reporting Processes

If you are part of a top financial planning and analysis (FP&A) team, you probably have at least one degree in finance, accounting, or business, and perhaps an MBA.

I'm guessing you don't have a degree in email management for requesting and compiling information from colleagues and then tracking the status of those requests. Or, a degree in copying and pasting text and data. Or, deciphering handwritten edits and formatting charts and graphs in the right shade of blue.

Yet, that may be part of the regular routine when it's time to create monthly management reports or execute year-end financial reporting.

A financial close with room for improvement might have finance and accounting teams working nights and weekends, with traditional tools limiting the impact of your best analysts, modelers, and problem solvers. With a more ideal close, highly engaged employees would have the right tools to complete their work with time left over for analysis, fulfilling ad hoc requests, and delivering forecasts that can shape the future of the business.

Advancing financial reporting processes

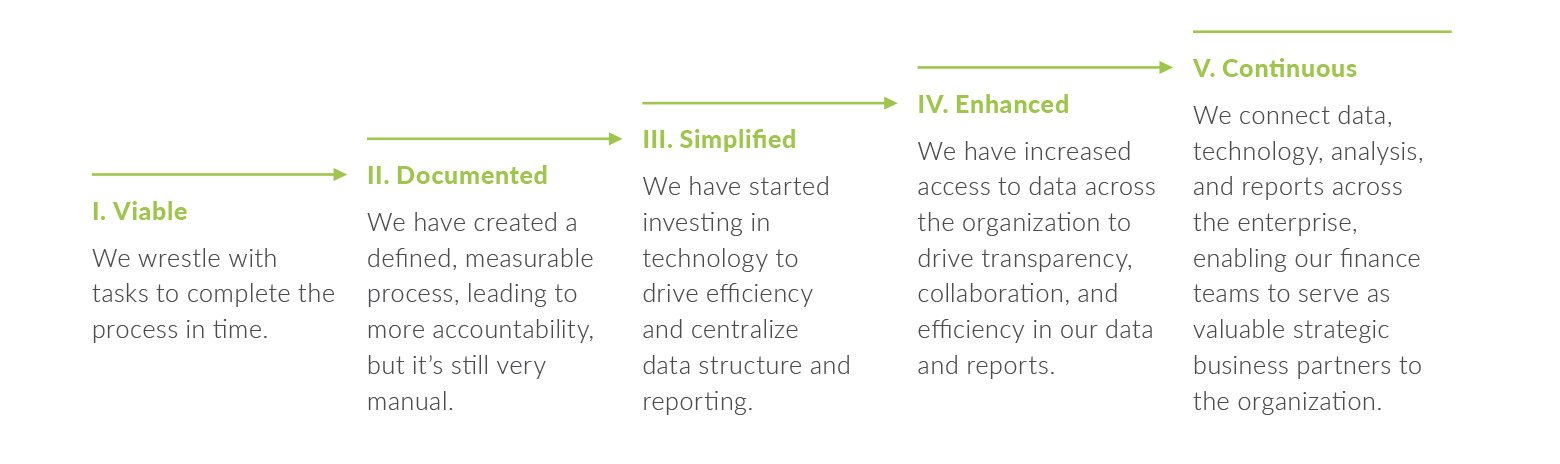

Charting the path from a viable financial close to a more connected, pain-free close is easier with a maturity model. The model can serve as a guide for improving the process for month-end reporting to management, as well as assessing your current financial reporting process.

The development or maturity of a financial reporting process can be gauged by evaluating the level of connectivity between the people, data, processes, and technology involved in the financial close.

My colleagues at Workiva have worked with more than 3,400 organizations to transform reporting and compliance. In our experience, the maturity of a financial reporting process tends to evolve like this, especially from the perspective of FP&A teams:

Level 1: Viable

Siloed teams are focused on simply completing the close. Oftentimes, it means staying late and skipping dinner with loved ones to get things done, even if it's a few days after a deadline.

Everyone pitches in, but undefined responsibilities can lead to duplicative work, unchecked errors, bottlenecks, and critical gaps if a key team member gets sick, retires, quits, or (gulp) gets called for jury duty. With undefined responsibilities, it's hard to hold anyone accountable or for individual team members to feel ownership over their work. In fact, their contributions may be limited by legacy systems and software.

In this stage, the organization struggles to define and maintain the process. Oftentimes, management needs to make sure employees don't burn out.

Getting to the next level: Documenting the process ensures it is defined, measurable, and easier to scale. Templated workflows establish who does what and on what timeline.

Level 2: Documented

With structured responsibilities and timelines, teams are better able to navigate what is still a complex, manual, time-consuming process for gathering structured and unstructured data, analyzing the information, creating reports, incorporating feedback from multiple reviewers, and delivering updated, mistake-free final results to the C-suite and beyond.

Because the team's work is measurable and roles are defined, individuals are more engaged, accountable, and proud of their contributions. They are able to execute the process.

There is improvement here, don't get me wrong. However, teams still consistently work past normal business hours, including the weekends. Team members follow the process but are unable to perform additional value-add tasks that allow the organization to truly understand and communicate business performance.

Getting to the next level: Short of busting the budget to hire more people, investing in technology to take over low-value tasks, like collecting or typing in data, may be the smartest option. After all, you want everyone on your team to feel challenged and fulfilled, not like they're clocking in for 12 more hours of mind-numbing tasks.

Level 3: Simplified

It's amazing what a little automation can do.

While introducing new technology can be a bold step, that single investment can transform your team's entire way of working. And it may not be as painful as you think. If you've ever dealt with implementing a new ERP project, you know it can cost upwards of hundreds of millions of dollars—but most technologies will not break the bank, especially when looking at the cloud. (The best ones will also integrate with existing technology investments to capitalize on what you already have.)

Technology can streamline workflow, so team members receive automatic alerts when information is updated, a task is overdue, or it's their turn to go into a project. Software integrations and APIs allow users to connect directly to systems and for data to automatically flow from those systems to new technologies.

Meanwhile, cloud platforms enable automation, real-time collaboration, and data assurance, meaning more efficiency, accuracy, and control of your process. Instead of babysitting tasks, analysts can focus on developing insights. Instead of spending hours compiling information, they might actually get to go home before midnight. Instead of checking the numbers for the tenth time, analysts can rest assured knowing the numbers are accurate.

You don't have to integrate the full capabilities of a new technology solution all at once. In fact, many organizations start by introducing new technology or a new platform to one core team first. Just make sure your new software or system can take you where you want to go in the future.

Getting to the next level: As the core team gets more comfortable using new technology, expand its use beyond your department to connect people across divisions, geographic regions, or partners.

Level 4: Enhanced

With software and systems that make it possible to have an enhanced financial close, teams enjoy increased transparency and collaboration. It's easier to see when, why, and how numbers have changed. Reports created by different teams are more consistent, and there is better data integrity. Software integrations drive connectivity of people, data, processes, and technology that are part of the financial reporting process. Internal and external parties can collaborate more smoothly.

Employees using the full scope of their expertise have higher morale and are more motivated to pursue advancement within the organization instead of looking elsewhere.

Getting to the next level: Explore how to get more out of your technology investment. Connect data to even more reports, spreadsheets, and presentations, even outside of finance and accounting, to your colleagues in the legal, compliance, risk, and marketing departments. Connect your technology investment to each other to create a continuous and automated reporting process.

Level 5: Continuous

Teams with the most mature financial close have connected structured data (like what you find in a database) from multiple source systems and unstructured data (such as text in an email) to their tools for reporting and analysis. This enables data to flow automatically to final reports and presentations for accuracy and consistency, even with last-minute changes. Public companies can also connect the data to earnings scripts, so the CEO and CFO are confident they have accurate, updated information before they hop on an earnings call. Public and private companies and nonprofit entities can connect data to internal reports, board or trustee presentations, covenant reports, and news releases.

A streamlined, defined process means your team can focus on the end results, not execution.

An ecosphere of integrated systems and software encourages natural collaboration, transparency, and a culture of accountability.

Team members are invested in their individual roles as well as delivering strategic insights that influence the entire organization.

Download a summary of the financial close maturity model.

The takeaway

CFOs and finance teams have a critical role to play in guiding and executing organizational transformation to fully deliver benefits to the bottom line, McKinsey & Co. partners note.

A more mature financial reporting process, with modern technology to connect the finance function to transformational efforts, enables finance leaders to clearly document goals, track progress in real time, and adjust forecasts in a transparent, collaborative way.

How mature is your financial close process? Take the self-assessment.