Finding Tools to Improve the Month-End Close Process

Simplifying the month-end (or year-end) financial reporting process is an ongoing journey best tackled with a thoughtful approach.

This blog post is the third in a series describing the five steps accounting and finance teams can take to simplify and improve the financial close process.

- Step 1: Create a process flowchart

- Step 2: Identify risks and opportunities

- Step 3: Find systems and tools for improvement

- Step 4: Implement process change

- Step 5: Continuously improve

In previous posts, I outlined the first two steps. After mapping your process and identifying risks and opportunities within that process, you are ready for step three: finding technology solutions to enable month-end close best practices.

Find month-end close software and tools

If you use the Gartner Magic Quadrant to evaluate cloud financial close solutions, you know that systems and tools are constantly evolving. A solution that can solve challenges across the financial close process, rather than bits and pieces of the process, may be the most cost-effective solution over the long term.

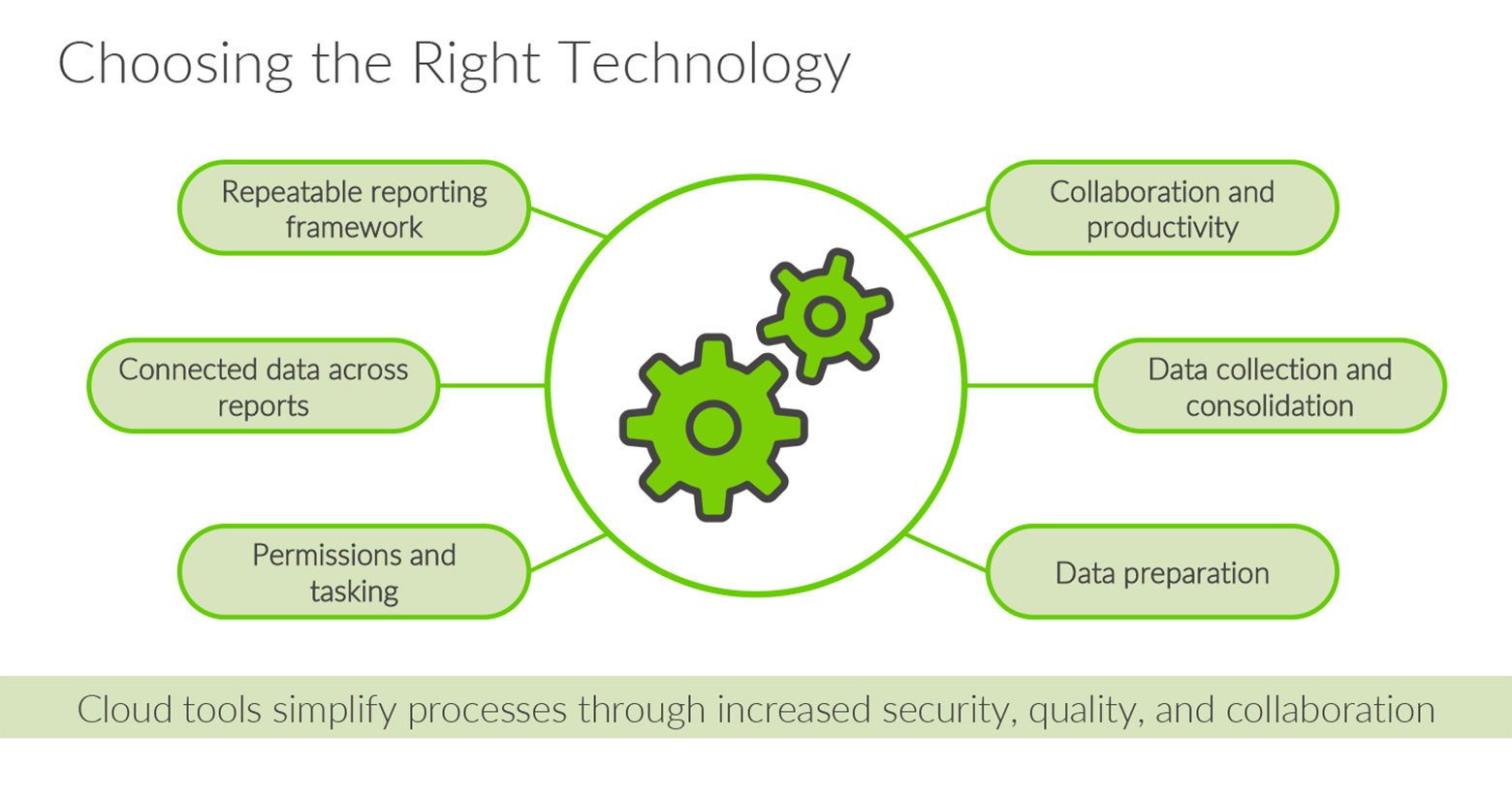

The technology you choose should fulfill this checklist to help you improve the month-end close reporting process. It should enable:

- Data collection and consolidation on a single platform

- Data preparation within the same platform

- Collaboration and productivity to improve efficiency

- Permissioning and tasking to streamline work across the organisation

- Connected data across reports, for consistency

- A repeatable reporting framework with simple roll forward capabilities

Before I joined Workiva, my team selected Wdesk to transform our reporting process. Regardless of the solution you select, cloud software can provide advantages over traditional PC-based spreadsheets, documents and presentations to efficiently solve several pain points in the financial close.

With traditional tools, multiple analysts might save and update files on their own machines, making it difficult for people later in the process to determine what version of a file is the most updated and accurate.

The cloud, on the other hand, makes it possible for collaborators with the right permissions to work on the same document at the same time, with an audit trail automatically capturing a full revision history, so users can quickly see what has changed.

Generally speaking, choosing a cloud financial close solution should involve four main steps:

- Determine the capabilities you would describe as mission critical

- Review analyst reports

- Compare vendors

- Research user reviews on sites such as Capterra or G2

In many cases, vendors can put you in touch with existing customers, or you can browse case studies online to see the results.

No matter which solution you choose, the new system or tool may represent a significant change for your teams. In my next post, I will discuss the next step in simplifying the financial close—how to successfully implement change.