Spotting Opportunities to Improve the Financial Close Process

This blog post is part two in a series describing the five steps accounting and finance teams can take to simplify and improve the financial close process:

- Step 1: Create a process flowchart

- Step 2: Identify risks and opportunities

- Step 3: Find systems and tools for improvement

- Step 4: Implement process change

- Step 5: Continuously improve

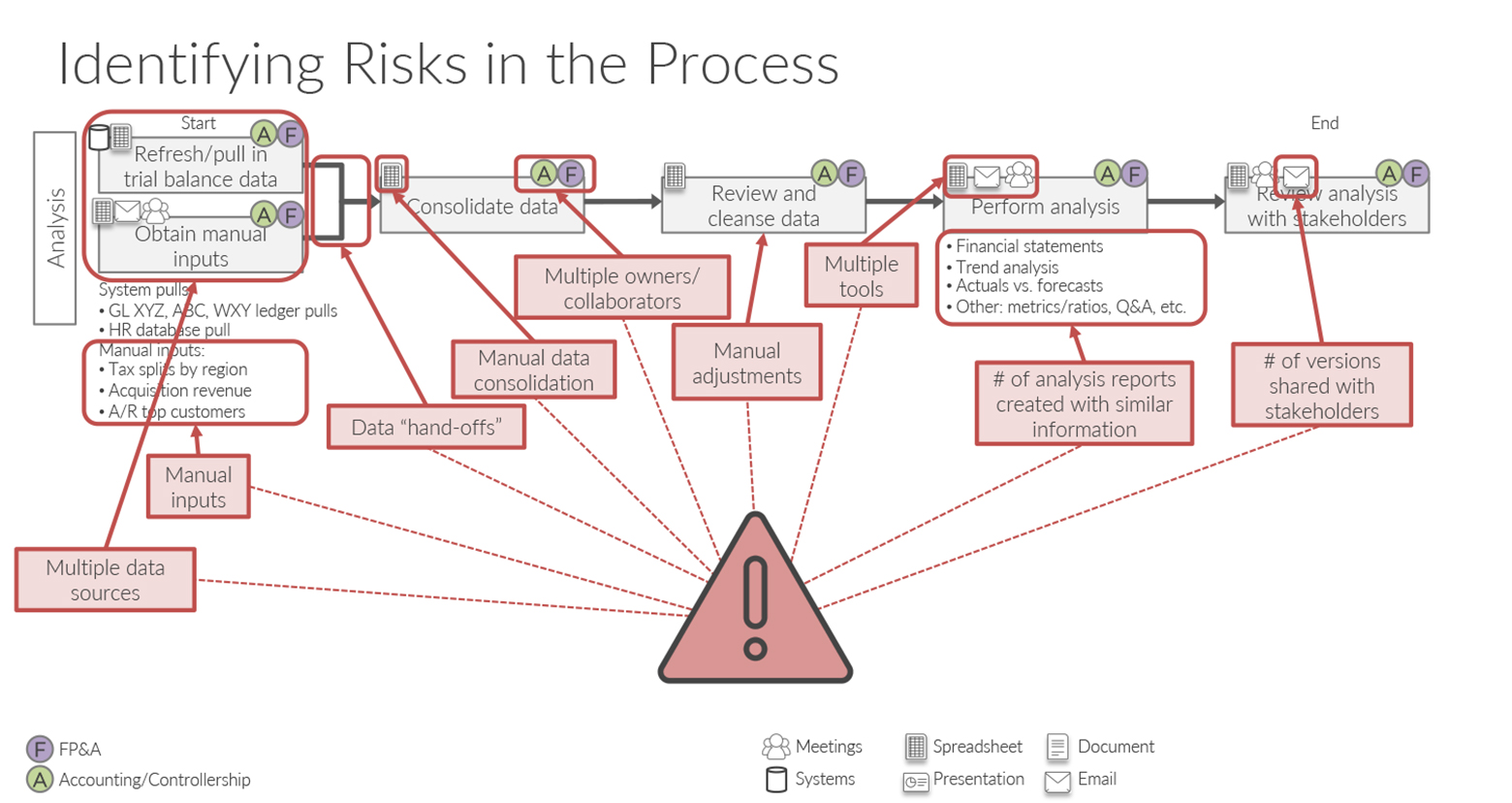

Last time, I described how to tackle the first step of creating a process flowchart. In this post, I will describe the second: using your flowchart to identify risks or areas where there could be breakdowns in your month-end close (or quarter-end or year-end reporting process). This will reveal opportunities for improvement, including a few areas that seem to come up over and over, no matter who your employer or what your industry is.

Let's dive in.

What to ask to identify risks

Wrangling data, working with multiple contributors and incorporating comments from reviewers who are working on different versions of a document can be frustrating parts of the month-end or year-end reporting process.

A financial reporting consultant for a private investment company told my colleagues about trying to incorporate input from up to 20 contributors into reports—but because of the risk of someone using an outdated version of a document stored on an individual laptop, not everyone had the latest information. "There's nothing more embarrassing than reporting a number in one financial statement and a totally different number in another because someone forgot to apply the change," he said.

Process owners like him are often in the best position to pinpoint potential risks in the reporting process and determine the magnitude of each risk. Ask for their input.

Get the conversation started with a few questions:

- Do your datasets come from any offline sources (word of mouth, Excel® templates, PowerPoint® presentations)?

- Do you have to update your data multiple times?

- Are there data and analysis handoffs in your process?

- Have you ever collected or used inaccurate numbers for analysis?

- Have you ever reported incomplete or inaccurate numbers?

- Do you have enough time for adequate review before presenting reports?

- Have there been instances of numbers pulled incorrectly out of a system/ERP?

- Is analysis prepared via desktop spreadsheets that collaborators cannot easily access?

- Do you need to manually create versions of your analysis (e.g., V1, V2, V3)?

Common risks

The input from your process owners should allow you to identify which parts of the process are vulnerable to errors or delays. The most common risks tend to stem from manual tasks. For example, if you rely on a colleague's analysis for your report, there is a risk that you may not have the most up-to-date information if the information has to be refreshed manually.

Opportunities to reduce complexity, increase efficiency

Your goal should be risk mitigation and simplification. Although it is unlikely that you will eliminate all risks, there are opportunities to mitigate risks by simplifying complex and manual processes. Typically, there is an opportunity to mitigate or eliminate the risk by automating more tedious parts of the process, improving transparency or expanding collaboration. I will get into that in a minute.

But first, here are a few questions to help identify opportunities to improve steps in the financial close process:.

- What steps can be streamlined or eliminated?

- How can we reduce, centralise or automate data inputs?

- How can we streamline and centralise our analysis across the organisation?

- How can we improve communication, visibility and collaboration?

Again, draw on the expertise of process owners by asking about their experiences:

- What is the most painful part of your process?

- What improvements would you recommend to alleviate these pain points?

- How much time do users spend preparing their data and analysis?

As promised, here are some common improvement opportunities:

Automation

Instead of tracking down data via email, phone calls or meetings, leverage collaborative software integrations and the cloud to help you populate data from enterprise systems into your reporting platform automatically.

Transparency

Are teams wasting time chasing down numbers or figuring out which version of a document is the most current? Audit trails that capture a complete history of what has changed and when (with comments to explain why something changed) can save you valuable time.

Collaboration

Can you break down silos, so analysts can share information and work more efficiently? Start by collecting data in a single repository where everyone can go to pull the latest numbers for analysis.

The next blog in this series will tackle the search for the right technology. See you then.

Excel and PowerPoint are registered trademarks of Microsoft Corporation in the United States and/or other countries.

Financial Reporting Process Improvement

Learn the common financial reporting challenges and methods for change.